Top 10 Heat Exchangers and Refrigeration Companies

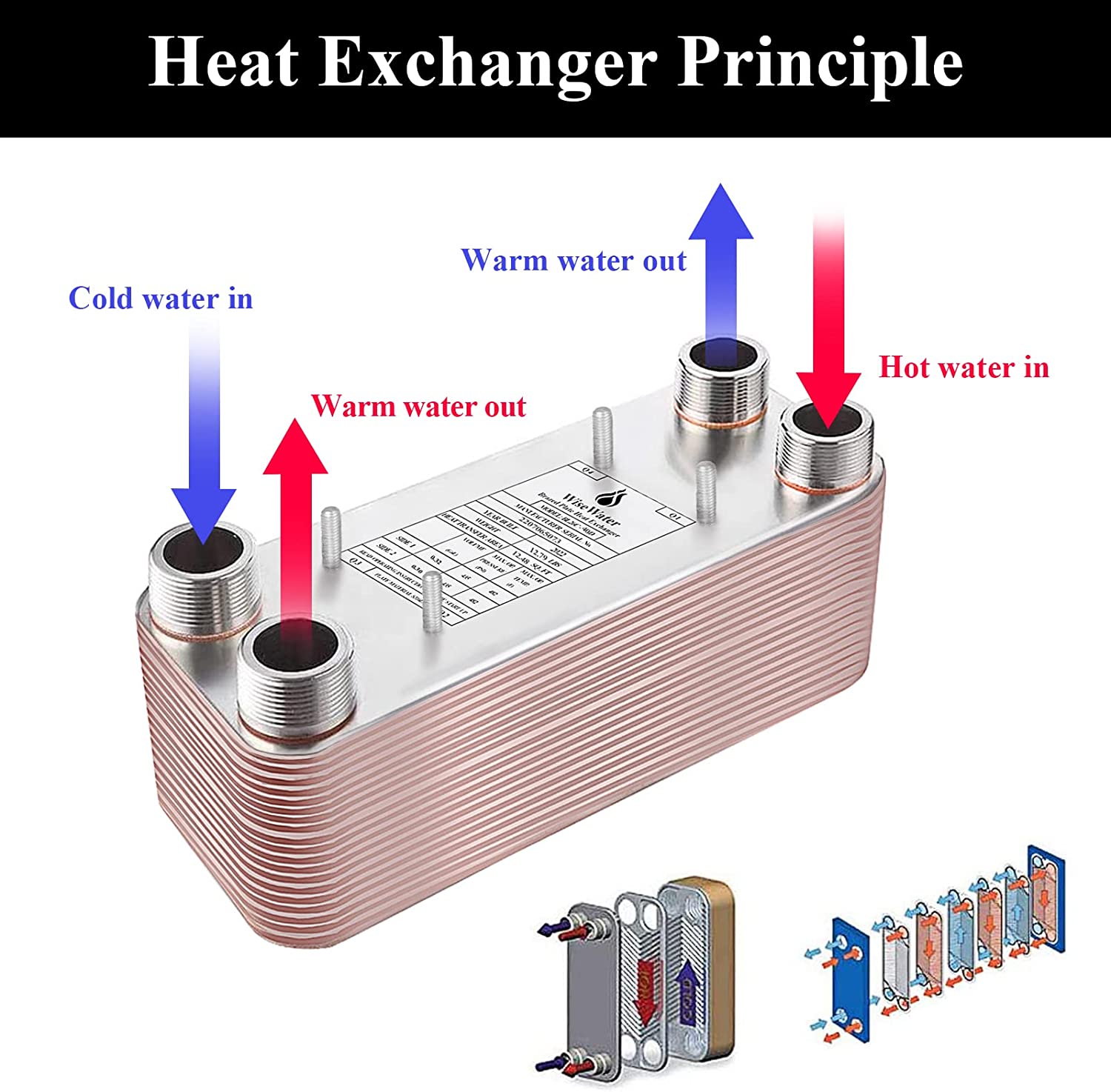

Heat exchangers and refrigeration systems are core components of modern industry and commerce. They are vital for everything from keeping food cold to cooling data centers. A heat exchanger transfers heat between two fluids through conduction and convection. A refrigeration system removes heat through mechanical or chemical processes. The global market is changing due to new energy efficiency standards and environmental rules, like the phase-out of HFC refrigerants. This list ranks the top ten global leaders based on innovation, market share, and sustainable practices.

How We Ranked the Companies

This ranking uses 2023 industry reports and financial data. Key metrics include annual revenue in billions of US dollars, global market share percentage, and spending on research and development. We also evaluated the range of products, such as plate, shell and tube, and microchannel heat exchangers. Compliance with environmental regulations like the F-Gas rules and ASHRAE standards was crucial. Innovation scores considered patents, the use of low-GWP refrigerants, and digital solutions like IoT for predictive maintenance.

Leaders in Heat Exchangers and Refrigeration: Rank 10 to 6

10. SPX Flow (United States)

SPX Flow specializes in APV brand plate heat exchangers. It holds a 19% market share in the food processing industry. Its key innovation is a double-wall plate design that prevents cross-contamination.

9. Güntner (Germany)

Güntner is a leader in dry coolers and condensers. Its GlyCool® technology combines glycol cooling with free cooling. This integration can lower energy use by 30%.

8. Danfoss (Denmark)

Danfoss provides a full range of components. It offers efficient T2 plate heat exchangers and compressors for natural refrigerants. The company invests 7.2% of its revenue back into research and development.

7. Alfa Laval (Sweden)

Alfa Laval is famous for its brazed plate heat exchangers. It commands a 22% market share. Its AlfaNova technology uses no brazing material, which extends the product's lifespan.

6. Baltimore Aircoil Company (BAC, United States)

BAC dominates the evaporative cooling tower market. Its V Series chillers use a fanless design. This innovation reduces noise by 50%, making it ideal for urban settings.

Leaders in Heat Exchangers and Refrigeration: Rank 5 to 1

5. Carrier Global Corporation (United States)

Carrier leads in commercial refrigeration systems like display cases. Its Greenspeed® Intelligence technology uses AI to optimize energy consumption. The company reports annual revenue over $20 billion.

4. Daikin Industries (Japan)

Daikin is an innovator in VRV refrigeration systems. It uses R-32 refrigerant, which has a 30% lower Global Warming Potential (GWP) than older options. Daikin holds an 18% share of the global market.

3. Trane Technologies (Ireland)

Trane's ThermoKing transport refrigeration systems are moving toward electrification. This shift helps reduce carbon emissions. The company currently holds 450 active patents.

2. Johnson Controls (Ireland)

Johnson Controls provides integrated solutions under its York brand. Its magnetic bearing centrifugal chillers achieve a Coefficient of Performance (COP) of 6.0. This is much higher than the industry average of 4.5.

1. LG Electronics (South Korea)

LG leads in both residential and commercial sectors. Its dual inverter heat pump technology improves energy efficiency by 40%. The company is also advancing the use of R-290 (propane) refrigerant, which helps meet EU 2030 carbon reduction goals.

Key Technology Trends

Innovation focuses on new materials and digital tools. Microchannel heat exchangers now use aluminum alloys. This makes them 50% lighter and 25% more thermally efficient. Phase Change Materials (PCMs), like paraffin-based systems, store thermal energy to balance demand.

Digital twin technology creates real-time simulations to predict failures. IoT sensors monitor pressure drops and temperature to schedule maintenance. New low-GWP refrigerants like R-1234ze (GWP<1) are becoming standard. AI algorithms dynamically adjust compressor speed to save energy at partial loads.

Focus on Sustainability and Environment

The industry is adopting a circular economy model. Manufacturers use recycled copper and aluminum, cutting virgin material use by 30%. Companies like Johnson Controls have set a net-zero carbon target for 2030. Improved sealing in refrigeration systems keeps leak rates below 5%. Air-cooled systems are replacing water-cooled ones to conserve water. Certifications from Eurovent and Energy Star ensure products meet high environmental standards.

Applications and Real-World Use Cases

These systems cool critical infrastructure. Carrier's ChillaBox for data centers uses indirect evaporative cooling. It achieves a Power Usage Effectiveness (PUE) as low as 1.2. In food retail, Daikin's systems use heat recovery to provide free heating. Alfa Laval's welded plate exchangers handle corrosive chemicals in industrial processes, lasting longer.

A European supermarket installed Trane's CO2 booster refrigeration system. It saved 35% in energy costs per year. The investment paid for itself in less than 3 years. A new application is electric vehicle thermal management, where microchannel heat exchangers control battery temperature.